I’ve been reading articles claiming a major impediment to closing sales is buyer’s ‘indecision’. But is non-buying called ‘indecision’ because people aren’t responding according to a seller’s expectations? Why is an entire field built upon persuading Others to act as per the needs of a stranger who has no understanding of the Other’s internal (and highly idiosyncratic) benchmarks?

I’ve been reading articles claiming a major impediment to closing sales is buyer’s ‘indecision’. But is non-buying called ‘indecision’ because people aren’t responding according to a seller’s expectations? Why is an entire field built upon persuading Others to act as per the needs of a stranger who has no understanding of the Other’s internal (and highly idiosyncratic) benchmarks?

Why do sellers think by ‘painting a compelling reason’ for prospects who have ‘cold feet’, or by providing a ‘burning platform’ to entice buying, they must get people to um, understand that ‘the pain of same is worse than the pain of change’? Why are the assumptions, the exhortations, based on what the seller wants? And, comically, on folks that aren’t self-identified buyers yet?

Why have sellers spent decades blaming people for not buying when they’ve ignored the processes that folks go through to bring in a new solution (so no cold feet, no laziness, no change avoidance)? After all, until they’re buyers the sales model is irrelevant for them – which explains (seller’s blame aside) the non-buying! They are not buyers yet!

SELLERS IGNORE RISKS TO STATUS QUO

I have more questions: Why is a non-purchase something to be managed by giving prospects jolts to take them beyond their alleged ‘laziness’ or ‘decision avoidance?’ What if people aren’t ‘lazy’ or ‘avoiding decisions’ but merely in a change/decision process the seller isn’t privy to?

What if the alleged ‘signs of indecision’ are a biased misreading of normal buy-in and change management practices that are not purchase-centered? What if people are NOT ‘avoiding change’ and don’t ‘prefer complacency’ or settle for ‘good enough?’

Why do sellers believe their jobs are to ‘break the gravitational pull’ and ‘beat the status quo’ rather than do something different to help them traverse their own unique decision process so they become buyers, so they understand the ‘cost’ involved with change, so everyone has bought in? Don’t sellers realize no one starts off wanting to buy anything, merely resolve a problem at the least ‘cost/risk’ to their system?

Do sellers even know what the status quo is – a unique mix of the unique people, policies, history, relationships, goals, job descriptions, etc. that make a culture operate successfully? And how, may I ask, with only ‘sales’ as their tool, would a seller know the risks to people and policies that must be managed for congruent change to happen within any unique status quo?

Why do sellers believe that prospects ‘wobble’, or ‘waiver’, or ‘back peddle’ when pushed for a close, when people (not even buyers yet!) are merely not finished getting buy-in, managing internal risks, trialing workarounds – or merely trying to get away from a pushy seller?

The term ‘decision avoidance’ has been around for decades. Sellers are warned they must ‘break the gravitational pull’ and ‘beat the status quo’. The ‘price’ issue has been an ongoing excuse. I even read this in an article recently (The Indecisive Buyer) on salesgravy.com:

“Why should anyone make a decision quickly if they don’t have to? More often than not, the buyers believe that by waiting, they will get a better deal. The salesperson will get scared and will think the only way to secure the sale is to offer a discount.”

Wait, what?

I think we should define sales as ‘A two-staged process involving facilitating the buying decision/change path, then placing solutions to those who become buyers’.

SALES ASSUMPTIONS ARE DISRESPECTFUL

There is profound disrespect inherent in all the above assumptions: Why is an entire industry so disrespectful, so eager to blame when the stubborn insistence on ONLY trying to sell (with no real knowledge as to what’s going on in the Other’s process) closes 5%, instead of recognizing that maybe something is wrong with the seller’s ‘need-focused’ assumption that there’s a ‘buyer’?

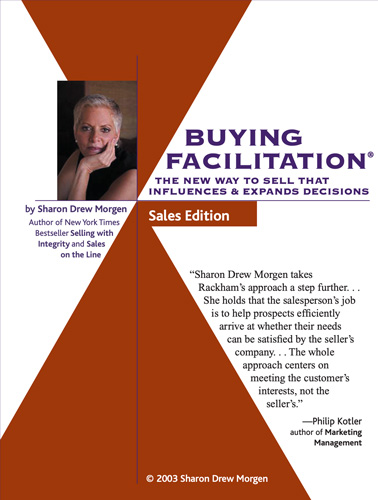

Indeed, decisions involving purchasing a solution only account for one third – the last third – of a buying decision. My clients, connecting first with Buying Facilitation® and a change facilitation focus that addresses the first two thirds of the change process, consistently close 40% against a sales-based control group that closes 5% with a ‘needs’ focus.

The very act of seeking those who seem (using biased thinking) to have a ‘need’ ignores 40% of those in process, and who will become buyers once they’re done. And as you’ll learn, it’s much, much more efficient to find prospects in the process of change than wrongly presume someone has a need and try try try to close.

And while I’m at it, why is it ok that the sales model carries an in-built, accepted, 95% failure rate? You wouldn’t even go to a hairdresser with a 95% failure rate! And an entire industry never considers that the outsized failure rate is a sign that just maybe the sales process is missing a few bits? Bits that could be discovered if they’d stop blaming people for not buying and instead look inward to recognize how they could be helping in a truly relevant way?

When I was a seller in corporate sales we said buyers were stupid. A favorite expression in the 80s and 90s was ‘buyers are liars’ (In 1992 David Sandler told me he was sorry he’d ever said that.). Sellers were told to be kind and charming, to make a personal connection, send out mass emails and play the percentages, get ‘through’ the gatekeeper. Anything to ‘get in front’ of that prospect! Anything! Assuming, of course, that once the prospect met the seller! Or heard about the product! they’d buy! Nope.

None, none of these silly excuses address what’s going on in the Buy Side!

WHEN DO PEOPLE BECOME BUYERS?

Have you ever considered that people aren’t buyers until certain benchmarks in their environment have been addressed? Sales professionals and marketers can facilitate these benchmarks. Just not with sales thinking.

The time it takes to figure out how to fix a problem in a way that causes the least risk to the system (AND there is buy-in, AND the ‘cost’ of a solution is lower than the ‘cost’ of maintaining the problem) is the length of the sales cycle. This is not indecision, a term used when

- the seller has determined a ‘need’,

- the seller believes a sale is imminent and has put the ‘prospect’ in their pipeline,

- a seller isn’t getting what s/he expects to occur,

- there’s no response to a pitch or marketing campaign,

- it’s taking ‘too long’ to close,

- the process involved in the prospect’s decision making is ignored.

Silence doesn’t mean back peddling, or complacency, or that a decision isn’t in progress. Someone recently asked me what to call people who haven’t yet become buyers. “People.” And People are who you’re blaming for not being buyers, people just trying to find excellence without disruption, without throwing the baby out with the bathwater. People who haven’t considered the option of buying anything. Yet.

People aren’t indecisive: they are going through a necessary, systemic process. It just doesn’t follow or heed the sales model. And until this change management process is complete, people will ignore sales outreach.

And yes, I recognize that the industry has used my concepts I developed 40 years ago of workarounds, buy-in, stakeholders, etc., and added them into the Sell Side, mentioning these points to would-be prospects and offering research on what Others have done to ‘beat the status quo.’

But as long as sellers continue to work in service of closing a sale instead of using a different thought process (and new skills, such as Facilitative Questions, listening for systems, etc.), with a goal to first facilitate systemic change, you’re still manipulating to get your own needs met. And people will resist you.

TWO-SIDED DATA SET

The sales model has no capability of understanding the idiosyncratic and complex issues people deal with to resolve a problem.

Potential buyers themselves have a confusing time trying to understand their full problem, something they cannot do until all the stakeholders have weighed in and the ‘cost’ of the risk involved is known. And sales folks NEVER speak with the entire set of stakeholders! (BTW using Buying Facilitation® you would!)

The truth is, using the just sales model, there is no way a seller can understand any of the challenges to change that prospective buyers face. It certainly does NOT help people assess the real risk to their system, even as they ‘paint a compelling picture of the pain of same’ with very very little real data. Not to mention actually believe they’re ‘smarter and more savvy than customers.’ (I actually heard a noted sales guru say this recently.)

Obviously, telling prospects what other companies have done to manage risk, is just silly, and another form of push sales. With no knowledge of the intricacies of a specific culture, or how the identified problem got created or maintained, there is no credible data from others that will be applicable.

And people are NOT in pain! That’s a sales word to mitigate assumptions.

EXAMPLES OF RISK IN THE BUYING DECISION PROCESS

People don’t want to buy anything, merely resolve a problem at the least ‘cost’ (risk) to their system: the ‘cost’ of a possible solution must be equal to or less than the ‘cost’ of the problem.

The status quo is maintained ONLY when the ‘cost’ of change is recognized as being higher than the ‘cost’ of the problem. If you need to fire 8 people to buy a new piece of software, which carries the most risk?

I did a pilot Buying Facilitation® (a change facilitation model I invented when I realized, as a seller-turned-entrepreneur, that the problem was in the buying process) training for Proctor and Gamble years ago. It was highly, highly successful – a massive increase over the control group. But they couldn’t train the entire sales force because it would cost $3,000,000,000 to change (new trucks and faster robots to handle the higher volume of sales, global rollouts etc.) and take two years to recoup the cost.

I did a BF pilot for Boston Scientific. Again, the pilot was massively more successful than the control group, but they thought the model was too controversial and disruptive: they’d need to change their marketing, follow-up, and customer service practices to employ it.

The pilot at Safelight Auto Glass was also highly successful. The reps made more money, closed more sales, faster. But the reps – hired to go out daily and deliver donuts (True story) as part of their ‘relationship management’ – all submitted their resignations en mass, a month after the course because they WANTED to be out in the field delivering donuts!

From the sales side, none of those stories make sense. But from the Buy Side, the cost of change was too high. They ‘needed’ my solution; they loved me and Buying Facilitation®; the companies understood that with Buying Facilitation® they made more money – a lot more money. The risk, the cost, the disruption, was too high. Nothing to do with need.

EXCUSES WHY BUYERS DON’T CLOSE

During the 43 years I’ve been teaching my Buying Facilitation® model I’ve heard bazillions of excuses that blame buyers, all from the Sell Side. But it doesn’t need to be this way.

See, buyers must do this anyway, with you or without you. By using only the sales model, you can only sell to those who show up as buyers. By adding change facilitation, you can enter at the beginning, facilitate them (with a change/leadership lens NOT a solution-placement lens) through to being ready to buy, THEN sell to people who are real buyers.

And with a change facilitator’s hat on, you can easily discover would-be buyers ON THE FIRST CALL that you can’t do with a sales hat on.

With my 7 books and hundreds of articles on facilitating buying, I’ve been describing how buyers buy, including recent articles on the Buy Side vs the Sell Side, and buyING vs BuyERS.

THE 13 STAGES OF THE BUYING DECISION PROCESS

There are two elements to the buying process:

- The change management end – where potential buyers reside and standard sales outreach doesn’t reach (they’re not self-identified as buyers yet);

- The purchasing end.

Sales does a great job with #2. By ignoring #1, you’re left pushing to ‘overcome indecision.’ But there’s no indecision: they’re just not ready yet.

Let me explain what’s going on. Decisions, including a buying decision, are just not so simple as weighting options. It’s about risk to the culture, the environment, the people, the norms, the jobs – the status quo. Risk avoidance (or maintaining Systems Congruence as systems thinkers call it) is a vital component of all decision making.

For our purposes, let’s call this change management process a buyING process. It includes 13 stages (written about extensively in my book Dirty Little Secrets):

- Idea stage: Is there a problem? Who needs to be involved to gather the full fact pattern?

- Brainstorming stage: Idea discussed broadly with colleagues.

- Initial discussion stage: Initial group of chosen colleagues discuss the problem to gather full fact pattern: how it got created/maintained; posit who to include on Buying Decision Team; consider possible fixes and fallout. Action groups formed to bring ideas for possible workarounds to next meeting. Invites for new, overlooked stakeholders to join.

- Contemplation stage: Workarounds (previous vendors, inhouse solutions) discussed for efficacy. People who will touch a solution to discuss their concerns to engage before they resist. More research necessary on possible solutions, ways to determine viable workarounds.

- Organization stage: Group gathers research to discuss upsides and downsides of workarounds. Viability of workarounds determined.

- Change management stage: If workarounds acceptable, group goes forward to plan to implement. If workarounds deemed unacceptable, group begins to consider downsides of external solutions: the ‘cost’(risk) of change, the ‘cost’ of a fix, the ‘cost’ of staying the same, and how much disruption is acceptable. Broad research for next meeting on solutions that might meet the criteria and ‘cost’ minimal disruption.

- Coordination stage: Dedicated discussions on research in re risk factors, buy-in issues, resistance. Delineate everyone’s thoughts re goals, acceptable risks, job changes, and change capacity. Must consider: workaround vs purchase vs status quo; decide on partial fix vs complete fix; decide on time criteria. Folks with resistance must be heard and group to decide how to include and dismantle resistance. Specific research to be assigned based on decisions reached. Discussions on next steps.

- Research stage: Discussion on research that’s brought in for each possible solution. Who is onboard with risk? How will change be managed with each possible solution? To include: downsides per type of solution, possibilities, outcomes, problems, management considerations, changes in policy, job description changes, HR issues, etc. and how these will be mitigated if purchase to be made – or discussion around maintaining the status quo instead of resolving the problem at all (i.e. cost too high). If a purchase is preferred option, list of possible types of solutions to purchase now defined; research for each to be ready for next meeting.

- Consensus stage: Known risks, change management procedures, buy-in and consensus necessary for each possibility. Buying Decision Team makes final choices: specific products and possible vendors are named. Criteria set for solution choice.

- Action stage: Responsibilities apportioned to manage the specifics of Step 9. Calls made to several vendors for interviews, presentations, and data gathering. Agreed-upon criteria applied with each vendor.

- Second brainstorming stage: Buying Decision Team discusses results of calls and interviews with vendors and partners, and fallout/benefits of each. Favored vendors pitched by team members among themselves, and then called for follow on meetings.

- Choice stage: New solution/vendor agreed on. Change management issues that need to be managed are delineated and put in place. Leadership initiatives prepared to avoid disruption.

- Implementation stage: Vendor contacted. Purchase made. Implement and follow on.

These comprise the complete decision path that everyone goes through before self-identifying as buyers. Notice they don’t begin considering buying until Stage 9 when they have their ducks in a row! Until then they’re only people trying to fix a problem at the least risk to the system. 40% of these people will be buyers once they complete their process.

Until then they’re merely People trying to solve a problem! The sales model is useless here! And there is no indecision.

SELLING IGNORES BUYING

Sales don’t close because of sales process only attracts the low hanging fruit who have completed their stages and show up as self-identified buyers. A buying decision starts of as systemic:

- Until everyone (all stakeholders who touch the current problem that needs resolving) adds their thoughts into the mix there is no way to fully understand the problem (and it follows, no way to consider a possible resolution). Sometimes it takes a period of time to recognize the full set of stakeholders. It’s certainly not as simple as it seems. Must they include ‘Joe in Accounting’? HR? Often stakeholders show up late in the decision process and the entire process must start from the beginning or face irreparable disruption.

- Until all workarounds are tried, until old vendors, other departments, friends and referrals are found and studied, outside solutions (i.e. purchases) will not be considered regardless of need or the efficacy of a specific solution. Any marketing materials or sales discussions will be ignored until internal fixes are found to not be viable.

- Until the full ‘cost’ (risk) of a proposed fix is understood and found to be less than the ‘cost’ of maintaining the status quo (i.e. cheaper than dealing with the originating problem), no action will be taken; the risk of disrupting the system is too great.

- Until the ‘cost’ is deemed manageable, AND the full set of stakeholders who will touch the final solution is on board, AND the team buys-in to any change involved, there will be no purchase and the status quo will be maintained.

And there can be no decision to purchase anything until completed.

NO ONE WANTS TO BUY ANYTHING

I’ve taught 100,000 clients Buying Facilitation® to use as a front end to sales. With specific questions (I invented a new form of question for this) we seek folks going through change in the area my solution supports – those who WILL become buyers instead of seeking those who have already self-identified and can use your website to get what they need.

No, you can’t use the sales model for this. Yes, you’ll need an additional tool kit; Buying Facilitation® uses Facilitative Questions, systems listening, the steps of change, and a commitment to facilitating systemic change before trying to sell anything. Read dozens of articles I’ve written on the subject.

Maybe it’s time to make Buying Facilitation® your new new thing, put the onus of blame on the restrictive sales model, and go beyond merely placing solutions – and actually sell more. This is what people REALLY need help with! They know how to find you, and how to buy once they get there. Help them get there.

Remember: you have nothing to sell if there is no one to buy.

__________________________________________

Sharon-Drew Morgen is a breakthrough innovator and original thinker, having developed new paradigms in sales (inventor Buying Facilitation®, listening/communication (What? Did you really say what I think I heard?), change management (The How of Change™), coaching, and leadership. She is the author of several books, including the NYTimes Business Bestseller Selling with Integrity and Dirty Little Secrets: why buyers can’t buy and sellers can’t sell). Sharon-Drew coaches and consults with companies seeking out of the box remedies for congruent, servant-leader-based change in leadership, healthcare, and sales. Her award-winning blog carries original articles with new thinking, weekly. www.sharon-drew.com She can be reached at sharondrew@sharondrewmorgen.com.

1 thought on “‘No Decision’ isn’t Indecision: people won’t buy until they’re buyers”

Pingback: What is Buying Facilitation®? What sales problem does it solve? - Sharon-Drew