Your important nonprofit or exciting startup will help the world be a better place, bring innovative ideas to the market, and be quite sucessful. You’ve created a terrific pitch deck, have a highly competent management team and terms, and have identified donor prospects with major gift potential. You’ve designed a multi-channel approach to build relationships with small investors to excite them to becoming large investors. Why aren’t you raising all the funding you deserve?

Your important nonprofit or exciting startup will help the world be a better place, bring innovative ideas to the market, and be quite sucessful. You’ve created a terrific pitch deck, have a highly competent management team and terms, and have identified donor prospects with major gift potential. You’ve designed a multi-channel approach to build relationships with small investors to excite them to becoming large investors. Why aren’t you raising all the funding you deserve?

- It’s not you, your message. or your organization;

- It’s not the strength of your relationship or who you ‘know’;

- It’s not the market, your competition, your return potential or your marketing materials.

It’s about how your investors will choose you over the competition. But do you know how, specifically, they’ll choose? Since each potential investor has unique, and unspoken criteria for choosing who to invest in, there’s no way to know. How, then, can you engage them?

HOW DO INVESTORS CHOOSE?

Investor funds are not sitting there waiting for you to show up, no matter how compelling your information, solution, management team or terms. They must choose from among several worthy investments. And certainly they’ll have unspoken, and possibly unconscious political, ecological, or personal biases.

Clearly they’re judging you against some criteria that you are unaware of, and you’re guessing what information to present based on your criteria. Unfortunately, the criteria don’t always match.

Sadly, as an outsider, you have no access to an investor’s hidden or historic arrangements, personal beliefs, or political mind-fields. And asking them directly about their criteria will only get you obvious answers.

How can you set yourself apart from the competition and flush out their choice criteria so you can make an effective pitch? Let’s begin by understanding the difference between how investors choose and what you offer.

ALIGN CRITERIA FIRST

Decades ago as a sales person, I realized the difference between choice criteria (personal, idiosyncratic) vs content (data) when attempting to engage a prospect. I was frustrated with the seeming gap between what I thought prospects needed (my solution, of course) and their willingness to buy, between the information I thought might persuade them and how they made decisions.

When I started up a tech company in London and became The Buyer I realized the problem: selling involved me getting my solution placed; buying involved me meeting specific criteria that managed risk so we could make necessary changes with minor disruption or wasted resource.

Now on the other side of the table, I realized that people bought, or invested, only once their own criteria were met. I had to shift from believing that my details would rule the day, to understanding I had to help investors recognize their own criteria and match it.

I did something I had never done: Rather than designing pitch materials based on what I thought they should know, I began my interactions with questions that helped them discern their decision criteria first, THEN presented my content in a way that fit.

TRUTHS ABOUT HOW INVESTORS DECIDE

To consider the components of a decision to invest, start-ups and scale-ups should consider how investors choose:

- Folks seeking funds have no way to understand an investor’s choice criteria as each has their own unique sets of rules, beliefs, values, vision they choose from. For example, some choose management as their criteria, some choose market size and potential for penetration, etc;

- Unless the investor’s choice criteria are met, no decision to buy or invest will be made;

- Unless the investor is willing to shift their criteria, they’ll consider presentation materials with a biased eye, regardless of the efficacy of the investment.

- Information is only relevant when it fits into the investor’s criteria or it will be ignored, resisted, or misunderstood.

To have the best chance to engage investors, begin by facilitating them through the internal, and often unconscious and biased, decisions they must make then customize your pitch to meet their specific criteria.

HOW TO MOTIVATE

Enter your fundraising session with a goal to facilitate decision making. Otherwise, you’re entering into a black box of unknowns, assuming that your ideas, your solutions, or the quality of your deck will get you funded. Money goes to those opportunities that first match their hidden criteria regardless of how you present.

Rather than attempting to inspire and provoke action with a brilliant pitch and deck, I begin my funding sessions by posing questions to help the investors discover their unconscious choice criteria.

For example: As a woman, I know only 4% of investor funds go to women (up from 1% in 1996!) so I pose a question to help them recognize their bias here. I might ask:

- How would you know that investing in a woman-owned company would be a good investment and offer an excellent opportunity for a high return on your investment?

By enabling them to make their choice criteria transparent and dialoguing with them, I let them tell me how I fit into their standards or not. THEN offer the specific information to address that specific criterion (and yes, I design a pitch deck with flexibility, beyond the content that I think is important.). So: Q&A first THEN pitch deck.

FACILITATIVE QUESTIONS THAT GENERATE REAL ANSWERS

I’d like to discuss the type of questions I pose. I’ve invented a new form of question that prompts the Other to discover their own answers, unbiased by my needs or assumptions. Facilitative Questions help Others discover their unconscious choice criteria.

(Note: FQs are brain-directional, not information gathering. They use different goals than conventional questions, with very specific words, in very specific order, in very specific sequences to get to the neural circuits within the Responder’s unconscious where their values-based criteria are stored. They are so different from standard questions that they can’t be learned without training. Here’s a link to a Learning Accelerator that will teach you how to formulate them.)

They not only find real answers, but instigate discussions to generate flexibility where possible. Here are some Facilitative Questions that I use during funding sessions:

- What would you need to see from me and my company to know it’s got a high probability of succeeding?

- What would you need to see to know we’re organized and managed for ongoing success, can enter the market competitively, and employ ethical standards?

- How would you know in advance that we represent collaboration, communication, and cooperation making us a good choice for partnership?

By posing these questions, you can dialogue with the investors first around substantive issues, begin a relationship, and get rid of the hidden criteria as much as possible. This will certainly differentiate you from your competitors. And don’t worry if some investors don’t want to play: they’re the ones who wouldn’t have invested in your anyway. It’s not only the investors who must choose: you get to choose who you want to get into bed with.

Remember: your solution is great. But so are the other solutions these investors are considering. The problem is not how to position your solution, but how to inspire investors to choose you.

____________

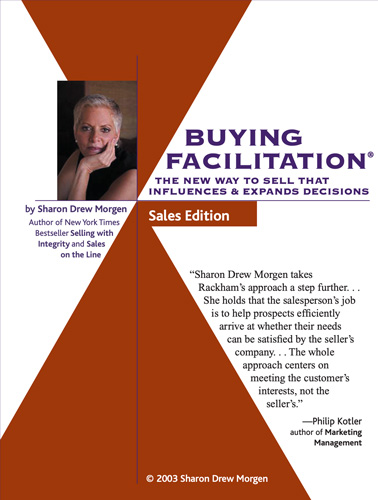

Sharon-Drew Morgen is a breakthrough innovator and original thinker, having developed new paradigms in sales (inventor Buying Facilitation®, listening/communication (What? Did you really say what I think I heard?), change management (The How of Change™), coaching, and leadership. She is the author of several books, including her new book HOW? Generating new neural circuits for learning, behavior change and decision making, the NYTimes Business Bestseller Selling with Integrity and Dirty Little Secrets: why buyers can’t buy and sellers can’t sell). Sharon-Drew coaches and consults with companies seeking out of the box remedies for congruent, servant-leader-based change in leadership, healthcare, and sales. Her award-winning blog carries original articles with new thinking, weekly. www.sharon-drew.com She can be reached at sharondrew@sharondrewmorgen.com.

2 thoughts on “Successful Fundraising: getting chosen over the competition”

Send Rakhi Gifts to India with

your enormous love and make your near and dear one happy. Send Online Rakhi to India and convey your warm affection to your

dear ones.

Pingback: Successful Fundraising: getting chosen over the competition - Startupnet